Cigarette demand varies with changes in price

20 May 2025

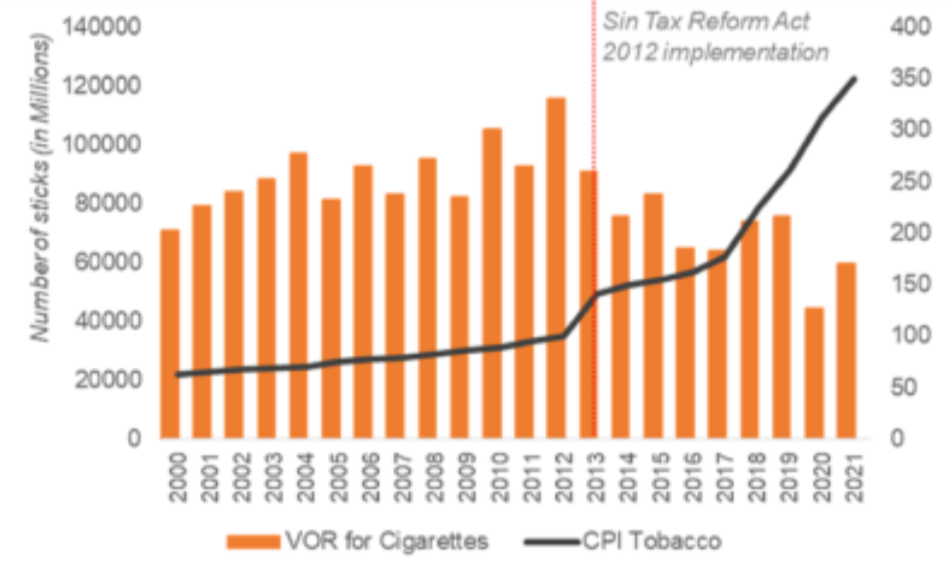

This study looks into how recent tax reforms on cigarettes and fermented liquor in the Philippines have affected people’s consumption habits. The government has raised taxes on these products over the past few years to reduce smoking and related health issues, as well as to generate funds for national health programs. The study proposes a new way to analyze this impact using readily available national data, as getting data from individual surveys in developing countries like the Philippines can be difficult. By analyzing data from 2000 to 2021, the study finds that the demand for cigarettes responds to price changes similarly to previous studies, while also providing new insights into fermented liquor consumption. This suggests that tax policies can indeed influence people’s health behaviors.

This paper contributes to the literature on price elasticity of demand estimation following tobacco and alcohol excise tax increases by proposing an alternative model that uses more frequently available data. The approach can be useful for countries facing data availability constraints. The study employed time series analysis that used more frequently (quarterly) collected national data–information that is typically available in low‐ and middle‐income countries like the Philippines. Studies that estimated price elasticity in the Philippines typically sourced their data from less frequently conducted household‐ and individual‐level surveys. Another contribution of this paper is the estimation of the price elasticity of demand for fermented liquors, as there are only a few studies that have examined the price elasticity of demand for alcohol products in the Philippines.

Authors: Rutcher M. Lacaza (School of Statistics, University of the Philippines | Congressional Policy and Budget Research Department, House of Representatives, Quezon City) and Miguel Antonio G. Estrada (Department of Public Administration and Policy, School of Public and International Affairs, University of Georgia)

Read the full paper: https://onlinelibrary.wiley.com/doi/full/10.1002/wmh3.615